The Virginia Small Business Development Center and Cureate Courses invite companies in the Charlottesville and Shenandoah Valley regions to apply for the inaugural cohort of the Food and Beverage Accelerator. This free, intensive 6-week program is designed to help the founders and CEOs of growth-oriented food and beverage producers acquire the competencies required to grow […]

Posts

Ever since helping his father sell produce at farmer’s markets and his mother cook for her small food business in a small town south of Bandung in the West Java province of Indonesia, opening a restaurant of his own has always appealed to Harrisonburg resident Hotmian Ridwan. With that passion for the food of his native Indonesia, a lot of hard work, and a little help from the programs of the Shenandoah Valley Small Business Development Center(SV SBDC), starting a small business has become reality for Ridwan.

Ridwan began working with the SV SBDC by participating in the “What’s Cooking” program, where he finalized his business plan and learned the necessary steps for starting a business.

“I refined the BoBoKo Indonesian Café’s concept by competing in a food related business concept competition, “What’s Cooking Program,” provided by the city of Harrisonburg and Rockingham County, Virginia’s partnering with the Shenandoah Valley Small Business Development Center. I received further encouragement to open this café after achieving first place in the competition.”

BoBoKo Indonesian Café has been proudly serving the Harrisonburg community traditional Indonesian cuisine ever since, emphasizing bold spices, rich flavors, and unusual tastes. Many reviewers call the café their local favorite:

“Our favorite restaurant in Harrisonburg!! We’ve had everything on the menu and love it all. Try the Indonesian noodles, they are to die for! Coconut pandan ice cream is amazing, so save room for that!”

The story of Ridwan’s small start-up business success has been a long and inspiring jolurney of determination and grit. Ridwan came to the United States through the H-2B Visa program, a work program that allows qualified U.S. employers to bring foreign nationals to the United States to fill temporary nonagricultural jobs they are unable to fill with U.S. residents. Ridwan was hired as a cook in various hotels and restaurants across the country, and eventually earned U.S. permanent resident status through a sponsorship from a local business owner in Harrisonburg. He began working full time as a chef and was later promoted to assistant manager because of his strong work ethic and culinary skills. When he became a U.S. citizen through naturalization in 2017, Ridwan started the process of building his business dream — a restaurant of his own where he could commemorate and celebrate the culinary culture that had shaped him.

The BoBoKo menu features a diverse array of dishes from traditional soups to stir fry and curry. They are also known for catering to customers with dietary restrictions by offering dairy free, gluten free, and vegan options.

Today Ridwan has over a dozen employees and contributes significantly to the Harrisonburg community by hosting fundraisers, making charitable donations, and sponsoring local events such as the annual Blacks Run Clean Up. No doubt the small business help and encouragement Ridwan received through the Shenandoah Valley Small Business Development Center’s programs were a catalyst for bringing this popular eatery to life.

Keeping Up with BoBoKo Indonesian Café

To check out BoBoKo’s extensive menu and learn more about them, you can either order online or visit them at 217 S Liberty St #102 in Harrisonburg, VA, 22801. Delicious Indonesian food awaits! Follow on social media and visit their blog for recipes and more great info. Information is subject to change due to COVID-19 restrictions, so please call or visit their channels for updates.

SBDCs launch COVID-19 recovery initiative to promote economic stability, sustainability, and growth.

The GO Virginia State board has approved an $81,813 grant proposal submitted by a regional partnership between Harrisonburg Economic Development, Frederick County Economic Development, Shenandoah Valley Small Business Development Center (SV SBDC), and Lord Fairfax Small Business Development Center (LF SBDC). This grant creates a Small Business Resiliency Team (SBRT) program with the goal of providing expanded business support services and technical assistance to area businesses in the wake of COVID-19 challenges. The program will deploy Business Resiliency Navigators to guide growth-oriented businesses through a dedicated and well-designed process for achieving incremental and sustainable growth throughout the pandemic recovery period.

Business Resiliency Navigators will work directly with small businesses, assisting with E-commerce, Financial Management, and Marketing needs. The SBRT’s focus is on tourism, retail, healthcare, and professional services businesses, however other companies will be considered. In addition to providing assessments, development of action plans, strategic counseling, and targeted training, the program will provide for services such as accounting, bookkeeping, website development, or e-commerce assistance rendered by industry experts as recommended by the SBRT.

The Virginia Initiative for Growth and Opportunity (GO Virginia) is a business-led initiative that was formed to foster private-sector growth and diversification across nine economic development regions in the Commonwealth. The GO Virginia Board administers state financial incentives designated for regional projects in order to encourage collaboration between private sector companies, workforce, education, and government.

Participating localities include the counties of Augusta, Clarke, Frederick, Rockbridge, Rockingham, and Shenandoah; and the cities of Harrisonburg, Waynesboro, and Winchester. Patrick Barker, CEcD, Executive Director of Frederick County will administer the grant.

“This partnership will be able to provide significantly more assistance to keep businesses healthy and growing in spite of the pandemic. Our SBDCs can collaborate and meet needs of Economic Development Offices throughout the Shenandoah Valley. Our goals include improving the local economy, assisting the participating businesses, and providing contracted work to local vendors for professional services,” said Joyce Krech, Director of the Shenandoah Valley SBDC.

The SBRT program supports GO Virginia goals by expanding regional capacity to coordinate and deliver business support services; helping businesses utilize e-commerce to increase sales; reducing service and production disruptions; encouraging the use of a remote workforce to keep workers employed and productive; and expanding existing training programs that are mission-critical. Expected results from dedicated participants include overall average business growth and retention of their current workforce.

“This grant award will help us keep many of the region’s growth-oriented businesses on a positive financial trajectory towards sustainable success. We will leverage existing resources and utilize GO Virginia funds to provide focused, hands-on consulting, training, and contracted work,” states Christine Kriz, Director of the Lord Fairfax SBDC.

For more information on the Small Business Resiliency Teams, click the SBRT tab on the navigation bar above.

For more information on GO Virginia, visit the Shenandoah Valley Partnership or the Virginia Department of Housing and Community Development.

About Small Business Development Centers. The SV and LF SBDCs are two of 27 Small Business Development Centers across Virginia providing professional business advice, training, and information resources to help grow and strengthen local businesses and Virginia’s economy. They are hosted respectively by James Madison University and Lord Fairfax Community College in partnership with George Mason University and funded in part by SBA and local governments. The Virginia SBDC Network is the most extensive business development program in the Commonwealth and part of America’s SBDC – the nation’s proven, cost-effective, and accredited infrastructure focused on small businesses – America’s job creators.

Welcome to the Business Resilience News Timeline

September 24, 2020

Rebuild VA has expanded its eligibility criteria to allow more small businesses to apply. The application is open and available here.

Small supply chain partners of businesses forced to close under Executive Order 53 or 55, as well as businesses that received CARES Act funding, are now eligible to receive a $10,000 Rebuild VA grant. Businesses that have received CARES Act funding must certify that they will only use the Rebuild VA grant for recurring expenses and that the grant will not be used to cover the same expenses as the other CARES Act funds.

Administered by the Department of Small Business and Supplier Diversity (SBSD), Rebuild VA has received over 3,000 applications. SBSD and its program partners, the Department of Housing and Community Development (DHCD), the Virginia Tourism Corporation (VTC), and the Virginia Economic Development Partnership (VEDP), made the decision to expand eligibility criteria after analysis of eligible and ineligible applications received within the first 30 days of the launch.

More details about the program, including eligibility criteria, may be found at https://www.governor.virginia.gov/rebuildva/.

In addition, DHCD has created a quick guide for multiple small business recovery programs in the agency. Click here to access the document.

September 14, 2020

Small Businesses & Recovery: What Customers Want

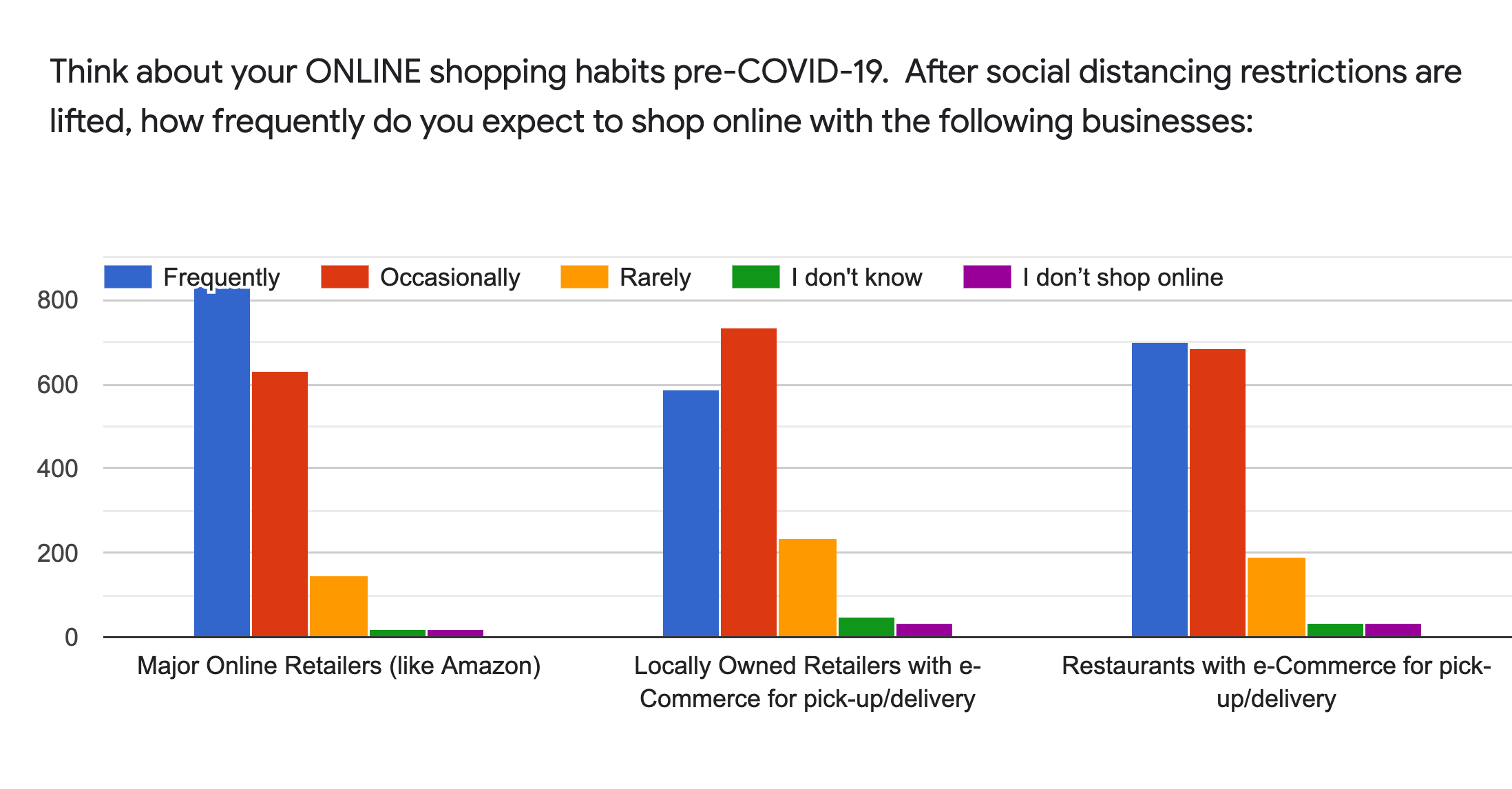

We surveyed the community to find out how they feel about a variety of topics related to public health and what influences the decisions they make about the places they visit and patron.

The previous implementation of this survey was administered in advance of the lifting of restrictions on small businesses and mass gatherings in Virginia. Those results depicted customers’ attitudes prior to Virginia entering Phase 1 of reopening.

This summary covers the results of a follow up to that survey, which was administered during Phase 3 of Virginia’s reopening. Brief comparisons are included at the end of each question to provide context on how customers’ attitudes have shifted since the previous survey.

The survey was shared by organizations and local governments in the City of Harrisonburg and Rockingham County. We received feedback from 435 survey respondents.

Key takeaways:

- Customers want businesses to make public health a priority. They want businesses to continue taking precautions that keep both employees and customers safe, and they want these precautious to be posted or shared, physically or virtually (Q1, Q11, Q12).

- There was a 21.9% increase in the number of survey respondents who said “employees wearing facemasks” impacted their level of comfort patronizing a business (Q1).

- Customers wish to touch as few common surfaces as possible (Q5, Q8, Q10).

- The number of people inside could impact customers’ desire to enter or stay (Q1, Q7).

- Many respondents indicated they have already started patronizing retail businesses and restaurants that offer outdoor dining; however, people show much more uncertainty when it comes to dining indoors and engaging in recreational activities (Q2).

- Buffet-style restaurants and other self-service options will make people uncomfortable for a long time, as evidenced by both the previous and current survey results (Q2).

- The majority of respondents do not feel comfortable attending events or gatherings – indoors or outdoors – despite adherence to social distancing guidelines (Q3).

- Moving forward, roughly 60% of respondents indicated interest in business and social networking events that are held either virtually or in small outdoor gatherings (Q4).

- Over 76% of respondents said locally owned businesses capture their attention with products, services, and specials using Facebook or word of mouth. 55% indicated that google search results are influential (Q6).

- Many intend to frequently or occasionally shop online with locally owned retailers and restaurants that have e-commerce options available for pick-up or delivery (Q9).

How could businesses respond?

- Follow CDC/VDH guidelines; regularly check for new information and adapt.

- Frequently disinfect commonly touched surfaces, such as handles and card machines. Do this in front of customers.

- Post signs explaining precautions outside and inside the establishment as well as on social media pages. Ensure all employees and customers are following what is posted.

- Continue using e-commerce systems; implement e-commerce if not already in place.

- Use Facebook and Instagram to enhance your marketing – highlighting actual products, menu, items and detailed descriptions that encourage people to make a purchase. Use google adwords as part of your marketing strategy so your website can get “found” more easily.

- Explore “touchless” and low-contact systems for your business, such as: disposable paper or QR Code menus, posted chalk board menus, touchless payment, and other strategies.

- Limit the number of patrons inside establishments. If it is feasible with the type of business or establishment, consider taking reservations (using free online tools) or making appointments.

- Install automatic hand sanitizer dispensers.

- Continue offering curbside pick-up and delivery options.

- Continue offering or try implementing “senior hours” for older customers.

- Use social media and e-newsletter lists to engage customers and ask for feedback on plans. Ask customers what you can do to retain their business through this time.

- Share positive Google/Facebook/Yelp reviews that recognize your efforts to keep your staff and customers safe on social media & let your customers speak for you!

VIEW THE ENTIRE Taskforce_Customer Survey Summary Phase 3

August 12, 2020

The Harrisonburg Business Recovery Grant program has launched! Grants for businesses with 1-100 employees are available. Grant amounts are between $4,000 and $10,000, based on the total employment of the business.

To view the eligibility criteria and to apply, visit: https://harrisonburgdevelopment.com/harrisonburg-business-…/

The deadline to apply is August 27th at 5:00pm.

August 11, 2020

REBUILD! VA Frequently Asked Questions

REBUILD! VA Application & Certification

August 11, 2020

New Resource Guide for Building a Sustainable Recreational Economy

USDA launched a resource guide to provide rural community leaders and economic development practitioners a complete list of programs at Rural Development, Forest Service, and National Institute for Food and Agriculture that can be used to support recreational economies in rural America.

USDA launched a resource guide to provide rural community leaders and economic development practitioners a complete list of programs at Rural Development, Forest Service, and National Institute for Food and Agriculture that can be used to support recreational economies in rural America.

This guide addresses key factors necessary to build a sustainable recreational economy including natural resource management, conservation activities, infrastructure investment, business development and more.

Download the resource guide:

Recreation Economy at USDA: Economic Development Resources for Rural Communities

July 31, 2020

Tips for Handling Legal Issues in the Wake of COVID-19

“Navigating the Legal Landscape During a Pandemic,” is a recently published guide by Online Master of Legal Studies Programs. The guide provides a glossary of related terms and FAQ’s to help individuals understand new legal situations. Tips on how to address common legal concerns such as employee and rental rights are detailed within the resource. The article also shares information on looking towards the future, such as how business professionals can prepare during and after a pandemic.

July 28, 2020

New Grant Opportunities for Small Businesses & Nonprofits Affected by COVID-19

Applicants must include the following supporting documentation with their application.

- SCC Certificate of Good Standing

- Incorporation documents for your business-or non-profit, including one of the following:

- Articles of Incorporation (e.g., C-Corp, S-Corp)

- Articles of Organization (e.g., LLC)

- Declaration of Partnership (e.g., Partnership)

- IRS Letter of Determination (e.g., 501c3)

- Business License (e.g., Sole Proprietor, Independent Contractor)

- Certificate of Fictitious Name (e.g., Sole Proprietor, Independent Contractor)

- Form 1099 (individual contractors)

- Current Owner Photo ID (e.g., VA Driver’s License, VA Real ID, Permanent Resident Card, Passport)

- Copies of 2019 Federal Income Tax Returns, and 2019 interim financial statement. If your 2019 Federal Income Tax Return has not been filed, a year-end profit-and-loss statement and balance sheet for 2019.

- Commonwealth of VA Substitute W-9 form

- Documentation demonstrating qualifying salary or payroll, including one of the following:

- VEC-FC-21/20 quarterly report

- Payroll processor records;

- Payroll tax filings;

- Form 1099-MISC; or

- Other documentation to demonstrate the qualifying salary or payroll

- Mortgage statements or rent/lease agreements

- Utility bills

- Paid invoices, contracts, cancelled checks, or other documentation to substantiate eligible COVID-19 expenses incurred to continue operations or re-open the business or non-profit.

One important point is that if a company has received government funding through the CARES ACT from any federal, state or local agency, they will not be eligible for this program. That would include any firm that received PPP, EIDL, CDBG, etc.

LEARN MORE

Main Street America, in partnership with The Hartford Small Business Insurance has created The HartBeat of Main Street Grant Program that will fund solutions to help small business owners respond and adapt to the COVID-19 pandemic, and also help to revitalize and strengthen older and historic downtown commercial districts. Grants of $5,000 to $15,000 will be awarded on a competitive and first-come, first-served basis. A minimum of 50 percent of grants will benefit diverse-owned businesses, as defined by the Small Business Administration as minority, woman, veteran, disabled, and/or LGBTQ-owned. This grant is now open and will close on August 23, 2020 at 11:59 pm PT or until 500 applications have been submitted, whichever is sooner.

HOW TO APPLY

Thanks to a $55 million significant commitment grant from Lowe’s partnering with LISC, small businesses can apply for emergency grant assistance desperately needed to stay afloat. Applications MUST be submitted by MONDAY, AUGUST 3rd ,11:59 p.m. EST.

HOW TO APPLY

June 26, 2020

Rockingham County Small Business Grant

Rockingham County, VA received funding from the Coronavirus Aid Relief and Economic Security (CARES) Act. The U.S. Department of Treasury guidance allows the CARES Act funds to be used for costs and expenses incurred because of the COVID-19 public health emergency, specifically mentioning the making of grants to small businesses.

A small business grant program will be the most efficient and effective way to distribute resources to small businesses in Rockingham County and its seven towns. The program can assist a small business with cash needed for working capital to support rent or mortgage payments, utility, payroll, or other similar expenses that occur in the ordinary course of business.

Applications will be accepted from July 13, 2020 until close of business, July 24, 2020. See the website and application for qualification criteria.

Grant information and link to application

June 16, 2020

SBA’s Economic Injury Disaster Loans and Advance Program Reopened to All Eligible Small Businesses and Non-Profits Impacted by COVID-19 Pandemic

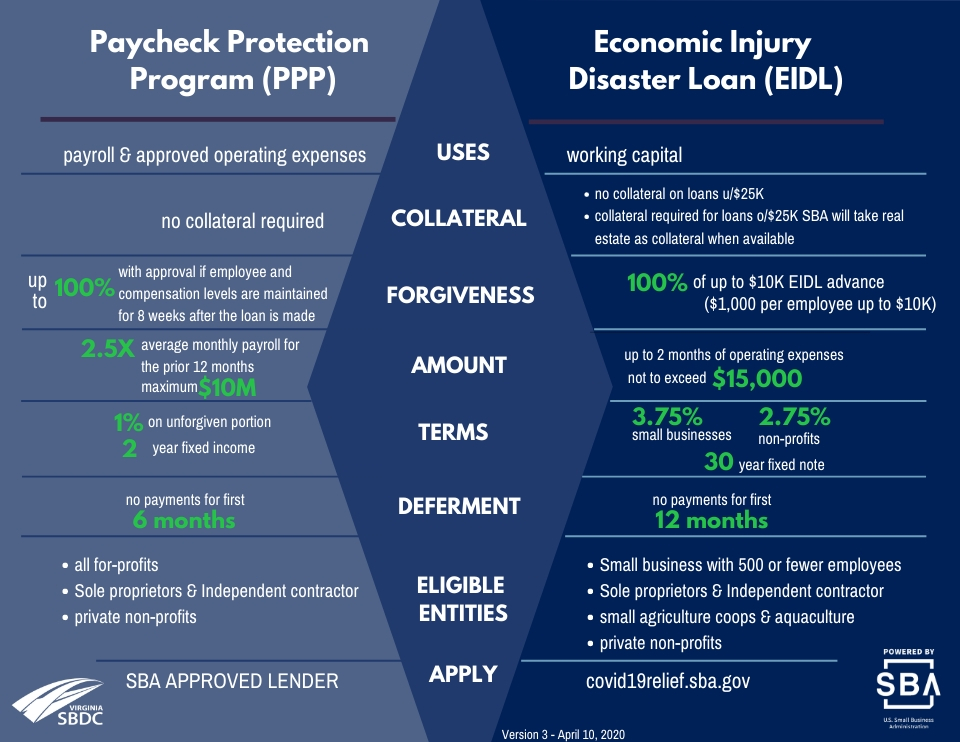

To further meet the needs of U.S. small businesses and non-profits, the U.S. Small Business Administration reopened the Economic Injury Disaster Loan (EIDL) and EIDL Advance program portal to all eligible applicants experiencing economic impacts due to COVID-19 today.

SBA’s COVID-19 Economic Injury Disaster Loan (EIDL) and EIDL Advance

- The SBA is offering low interest federal disaster loans for working capital to small businesses and non-profit organizations that are suffering substantial economic injury as a result of COVID-19 in all U.S. states, Washington D.C., and territories.

- These loans may be used to pay debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact, and that are not already covered by a Paycheck Protection Program loan. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%.

- To keep payments affordable for small businesses, SBA offers loans with long repayment terms, up to a maximum of 30 years. Plus, the first payment is deferred for one year.

- In addition, small businesses and non-profits may request, as part of their loan application, an EIDL Advance of up to $10,000. The EIDL Advance is designed to provide emergency economic relief to businesses that are currently experiencing a temporary loss of revenue. This advance will not have to be repaid, and small businesses may receive an advance even if they are not approved for a loan.

- SBA’s EIDL and EIDL Advance are just one piece of the expanded focus of the federal government’s coordinated response.

- The SBA is also assisting small businesses and non-profits with access to the federal forgivable loan program, the Paycheck Protection Program, which is currently accepting applications until June 30, 2020.

For additional information, please visit the SBA disaster assistance website at SBA.gov/Disaster.

June 12, 2020

COVID-19 Business Recovery Survey

Our economy across the country has certainly seen a lot of disruption through the COVID-19 pandemic and re-opening the economy has and will continue to see many challenges. We are, however, a very creative, entrepreneurial and resilient people in the U.S., Commonwealth of Virginia and the Shenandoah Valley.

As reported before, the Harrisonburg-Rockingham COVID-19 Business (Response) Resilience Taskforce was established to coordinate and support efforts to help businesses and employers make it through this challenging time. While we are now in Phase 2 of re-opening Virginia’s economy, there are still many needs and obstacles. The Shenandoah Valley Guide to Re-opening Business was recently released and has already been updated. The Virginia Chamber just sent out Blueprint for Getting Virginia Back to Work on Wednesday.

The Taskforce will continue working together to get our economy once again moving forward. In order for us to gauge the progress since early May and to determine what else can be done to help the transition back to “normal”, please complete this Business Recovery Survey by the end of the day on June 19th.

Summary results will be shared for continued recovery planning purposes. If you have any questions, contact Frank Tamberrino at frank@hrchamber.org. If you are not the right person in your organization to complete this survey, please pass it on to the appropriate individual.

June 5, 2020

Phase Two Guidelines Virginia-Forward-Phase-Two-Guidelines 6-2-2020

May 27, 2020

Guide to Re-opening Businesses

May 11, 2020

Reopening Small Business What Customers Want survey results

New! RECOVERY RESOURCES for Small Business through the Virginia SBDC Network

Review – Reopen – Recover is a downloadable PDF Checklist to help you asses where you and your business are financially, reviews your re-opening plan and helps you think over your marketing strategy.

May 4, 2020

The SBA has resumed processing EIDL applications that were submitted before the portal stopped accepting new applications on April 15 and will be processing these applications on a first-come, first-served basis. SBA will begin accepting new Economic Injury Disaster Loan (EIDL) and EIDL Advance applications on a limited basis only to provide relief to U.S. agricultural businesses.

The new eligibility is made possible as a result of the latest round of funds appropriated by Congress in response to the COVID-19 pandemic.

- Agricultural businesses includes those businesses engaged in the production of food and fiber, ranching, and raising of livestock, aquaculture, and all other farming and agricultural related industries (as defined by section 18(b) of the Small Business Act (15 U.S.C. 647(b)).

- SBA is encouraging all eligible agricultural businesses with 500 or fewer employees wishing to apply to begin preparing their business financial information needed for their application.

At this time, only agricultural business applications will be accepted due to limitations in funding availability and the unprecedented submission of applications already received. Applicants who have already submitted their applications will continue to be processed on a first-come, first-served basis. For agricultural businesses that submitted an EIDL application through the streamlined application portal prior to the legislative change, SBA will process these applications without the need for re-applying.

Eligible agricultural businesses may apply for the Loan Advance here.

May 1, 2020

The Harrisonburg-Rockingham Small Business Resiliency Grant program received 45 new applications seeking over $225,000 in assistance. Seven second-round grant applicants received between $2500-$4000 each for a total of $26,000 funds awarded. The total funds distributed since April 10th equals $91,000 distributed to area small business!

~~~

April 17, 2020

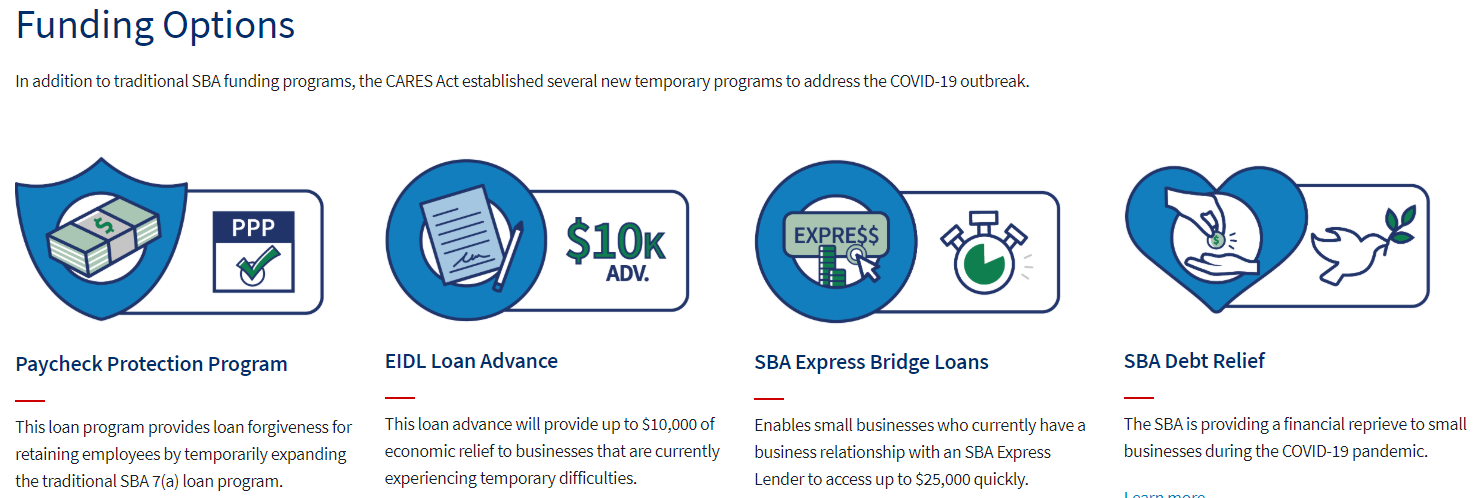

The U.S. Chamber of Commerce has been providing timely reporting and creating easy to follow guides with information on the CARES Act programs.

Small Business Emergency Loans Guide

NEW: Guide for Independent Contractors

NEW: Guide for Independent Contractors

April 15, 2020

Using the CARES Act to Support Child Care in Virginia

Virginia is committed to supporting child care and ensuring essential personnel can work.

How to Apply

● Child care providers that are open, serving essential personnel, and want to apply for the new grant program

should look for information on how to apply at childcareva.com. Download the CARES Grant Application Form

● Providers participating in the Child Care Subsidy Program should consult the communications that will be

emailed directly to them and the FAQs available on this PDF. Questions may also be submitted to the

Virginia Department of Social Services at vendor.services@dss.virginia.gov.

April 13, 2020

Tremendous resources to the local community AND the greater area are listed on the Harrisonburg Downtown Renaissance COVID-19 Business Resources page

The Shenandoah Valley Battlefields Foundation has established a Historic Sites Emergency Grant Fund to assist partners in the Shenandoah Valley during the COVID-19 Pandemic. This program is intended to provide support for historic sites who are or will be suffering financial hardship due to the interruption of normal operations caused by the Coronavirus public health crisis. Sites must be able to demonstrate their need by showing loss or expected loss due to reduced visitation and revenue. For more information and the application, go to the Historic Sites Emergency Grants Information website

April 10, 2020

Harrisonburg-Rockingham COVID-19 Business Support Taskforce Awards 25 Small Business Grants

The Harrisonburg-Rockingham COVID-19 Business Support Taskforce that formed last month to quickly coordinate support and resources for businesses in the Harrisonburg and Rockingham area in response to the COVID-19 pandemic has awarded $50,000 in grants, funded by the generous donation from F&M Bank, to 20 area small businesses, and another $15,000 to 5 more area businesses with additional financial support from Wells Fargo and Atlantic Union Bank.

The Harrisonburg-Rockingham Small Business Resiliency Grant program received 100 applications seeking over $400,000 in assistance. Grant recipients received between $1500-$5000 and represent businesses ranging from restaurants to light manufacturing. In addition to the 25 businesses assisted, the number of jobs potentially impacted and ultimately saved could be over 150.

“We sincerely appreciate the quick and generous support of the bankers who have supported the Business Resiliency Fund. The need, just hearing about the number of applications, is great at this time and this is just one more example of this community stepping up when people are in need” said Aaron Ludwig, owner of Jack Brown’s and Billy Jack’s in Harrisonburg.

Christine McLaughlin, co-owner of Valley Olive Oil & Balsamics in McGaheysville, summed up her appreciation for a grant with “Thanks to some wonderful people keeping an eye out for us. With the Harrisonburg Rockingham Business Support Taskforce’s Small Business Resilience Grant, we will make it through this and be able to stay open for our wonderful customers! We are so appreciative for the help and everyone who made this grant possible for all the businesses hit hard during this pandemic!”

Businesses located in Harrisonburg and Rockingham County are encouraged to submit applications as they will be reviewed on a rolling basis as additional funding is received. Businesses eligible to apply are those that have been located in Harrisonburg or Rockingham County for at least a year and that have 25 or fewer employees. Funding can be used for managing operational costs like payroll, rent, and similar expenses.

Applicants who weren’t selected are also being encouraged to connect with the Shenandoah Valley Small Business Development Center for guidance and advice in addition to applying for federal assistance.

Make a Donation to the Fund

The Taskforce has partnered with the Community Foundation of Harrisonburg and Rockingham County to accept additional donations for the fund. Gifts may be made online at www.tcfhr.org or by mailing a check to The Community Foundation of Harrisonburg & Rockingham County, P O Box 1068, Harrisonburg, VA 22803. Please note the “Harrisonburg-Rockingham Business Resiliency Fund” on the check.

About The Harrisonburg-Rockingham COVID-19 Business Support Taskforce

The Harrisonburg-Rockingham COVID-19 Business Support Taskforce is an ad-hoc group convened to coordinate resources, information, and support for the business community in response to the nation’s pandemic. Members include representatives from the Harrisonburg-Rockingham Chamber of Commerce, the City of Harrisonburg Economic Development, the Shenandoah Valley Partnership, the Shenandoah Valley Small Business Development Center (SVSBDC), Harrisonburg Downtown Renaissance, Rockingham Department of Economic Development and Tourism, and the Shenandoah Valley Technology Council.

April 8, 2020

PBMares has launched a weekly webinar series to help you navigate through this unprecedented disruption. The webinars will provide you timely insights, resources & recommendations. As the COVID-19 disruption continues to evolve, their webinars will focus on the most important opportunities available to you and your business. Our subject matter experts will provide you additional insights into:

- CARES Act

- Paycheck Protection Program (PPP)

- Small Business Administration’s EIDL Program

- Liquidity & Cash Flow Management

- Remote Workforce Planning

Please register for the webinar series here: pbmares.com/covid-19-webinar-series

~~Immerge, A division of McClung Companies has developed a Shop Local page to support local businesses in the Shenandoah Valley! Submit your retail or service contact information here: www.shoplocalshenvalley.com

The Immergetech Team located in Harrisonburg, VA serving the Shenandoah Valley with Website Design, Digital Marketing and more…

For additional funding opportunities, check our Business Resource Page

March 31, 2020

With $349 Billion in Emergency Small Business Capital Cleared, SBA and Treasury Begin Unprecedented Public-Private Mobilization Effort to Distribute Funds

WASHINGTON – Following President Trump’s signing of the historic Coronavirus Aid, Relief, and Economic Security (CARES) Act, SBA Administrator Jovita Carranza and Treasury Secretary Steven T. Mnuchin today announced that the SBA and Treasury Department have initiated a robust mobilization effort of banks and other lending institutions to provide small businesses with the capital they need.

The Paycheck Protection Program is specifically designed to help small businesses keep their workforce employed. Visit SBA.gov/Coronavirus for more information on the Paycheck Protection Program.

• The new loan program will be available retroactive from Feb. 15, 2020, so employers can rehire their recently laid-off employees through June 30, 2020.

Loan Terms & Conditions

• Eligible businesses: All businesses, including non-profits, Veterans organizations, Tribal concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries

• Maximum loan amount up to $10 million

• Loan forgiveness if proceeds used for payroll costs and other designated business operating expenses in the 8 weeks following the date of loan origination (due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs)

• All loans under this program will have the following identical features:

o Interest rate of 1.0%

o Maturity of 2 years

o First payment deferred for six months

o 100% guarantee by SBA

o No collateral

o No personal guarantees

o No borrower or lender fees payable to SBA

###

Click for Virginia SBA Lender Ranking information

Monday, March 30th

The SBA is working to streamline the loan application process. New guidelines to apply for the Economic Injury Disaster Loan is found here: covid19relief.sba.gov

This is the main SBA page for a review of all the programs: www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

Additionally, there is new information on a $10,000 Loan Advance:

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000.

The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid.

The CARES Act Guide is a downloadable PDF from the U.S. Senate Committee on Small Business & Entrepreneurship and outlines the latest programs:

Paycheck Protection Program Loans

Small Business Debt Relief Program

Economic Injury Disaster Loans and Emergency Economic Injury Grants

Friday, March 27th

What a week! So much has happened just in the last two days, including the latest legislation. In anticipation of this bill, there is a document from the U. S. Senate Committee that we can share for your reading pleasure over the weekend from Senator Tim Kaine’s office via your H-R Chamber: Small Business Owner Guide.

NEW From Rockingham County: A Business & Organization Status GIS Mapping Tool

As part of the County Coronavirus alert and GIS hub, an application was created to support community business and organizations to assist the efforts of the recently formed Regional COVID-19 Business Support Task force. The following link could be shared with news media, Chamber, SVP, Downtown Renaissance and tourism sites as well in order to facilitate community business and organization operational status. Organizations can use the “Submit Form” link to add their organization along with operational information. Users can utilize the “Near Me” feature to search for businesses and organizations within their device’s location (either mobile or desktop)

This is an application which could prove valuable for other applications for the County. Thanks to Mark Rathke and his colleague Bradford for creating this tool!For more on Maps, check out: How to Visualize Data for Your Area on data.census.gov: In this brief video tutorial, discover how to visualize the most popular statistics for your area through the data visualization profiles on data.census.gov.

The Valley Strong

The Valley Strong

Neighbors Helping Neighbors is a movement to help support local businesses today, so they can keep their doors open tomorrow.

Hosted by the Harrisonburg Radio Group with hashtag #TheValley Strong is a directory of local Businesses, Gift Cards and Job announcements, and a direct link to WSVA Radio so you can hear the latest news.

The Shenandoah Valley Partnership has an excellent COVID-19 Response Page with links pertaining to the entire Valley.

Public Private Strategies has curated a list of resources that have been made available by advocacy groups, technology companies, and federal, state, and local government agencies to help businesses and their workers maintain their physical and economic health during the coronavirus 2019 (COVID-19) outbreak.

From Wednesday, March 25th: Yes, it already seems like a week ago doesn’t it?

Resources from the U.S. Chamber of Commerce

The U.S. Chamber continues to create, update, and evolve our various resources—including the Live Blog, Coronavirus Response Toolkit, Small Business Guide, Coronavirus Workplace Flyer, and more—to ensure that you and your members have the most up to date information and impactful tools to navigate this pandemic. For additional information and resources please visit the Virginia Chamber of Commerce’s COVID-19 Resource Center.

Status of Building Officials’ offices across the Commonwealth on VBCOA website

Virginia Manufacturer Association VMA COVID-19 Resource Page

Virginia Department of Professional and Occupational Regulation COVID-19 Update Page outlines regulated non-essential businesses that most close

Many businesses are having questions about classification of Employee vs Independent Contractor. See IRS Revenue Ruling 87-41: The Twenty Factors

FEMA has a page on HOW TO HELP that gives contact information producing COVID-19 related products. *Contact the SBDC office if you want more detail on the challenges of creating/manufacturing personal protective products, and we’ll put you in touch with our International Trade Manager and other subject matter experts.

On Wednesday, April 1st, Renee Haltom, Vice President and Regional Executive of the Federal Reserve Bank of Richmond spoke to H-R Chamber members and here is how she would like for us to participate.

Dear Shenandoah Valley small businesses,

Right now it is more important than ever for the Federal Reserve to understand how business leaders are experiencing the economy. Therefore, I’d like to make a special appeal for you to join our monthly survey of business conditions.

By way of background: Each month the Richmond Fed asks business executives in our region to answer a short questionnaire on current business conditions. We have one survey for manufacturing firms and another for non-manufacturing firms. The information we collect helps us understand the current economy in a way that is often more up-to-date and with deeper context than formal data can reveal – so it is a critical contribution to monetary policy, and really is a public service. Individual responses are kept confidential, but the aggregated results are published on our website and are followed widely by the media. The survey includes the ability to add comments – which, again, are kept confidential – and therefore gives you a voice directly to the Federal Reserve.

It is a short (5 minutes) online survey, and we are now including special questions about the effects of the COVID-19 virus. We would be grateful for your participation in this critical time and going forward. If you’re willing to participate, please contact Rich.RegionalSurveyTeam@rich.frb.org or call us at 804-697-8152.

I will add that my role at the Richmond Fed is to meet with business leaders to understand the economy. So I am eager to hear from businesses directly – both in normal times (on issues stemming from growth prospects to labor to prices), but especially now to understand how the virus and associated relief efforts are affecting you. If you have insights to share, please feel free to contact me at any time at renee.haltom@rich.frb.org.

Many thanks, and I hope to see you all virtually or in person soon.

Best regards,

Renee Haltom

Vice President and Regional Executive

The Federal Reserve Bank of Richmond

(804) 697-8401

https://www.richmondfed.org/research/people/haltom

renee.haltom@rich.frb.org

# # #

It was mid-December 2015 when James (Jay) North learned that the vendor-based market where he sold his home décor and antiques was being shut down. He and the other vendors were facing the end of their small businesses.

Not willing to accept this, Jay and a committed group of owners stepped up to create a new organization that would serve the local business community. They sought guidance from the Shenandoah Valley SBDC and advisor Sara Levinson, who lives and works in Page County.

The first item of business: establish The Hawksbill Trading Company as a co-operative. According to Jay, without the SBDC’s guidance this would never have been possible. The new board worked diligently with Sara to create membership applications and vendor contracts, draft by-laws and other organizational documents, set up a new accounting system, and manage all the other aspects for a new venture.

“Every vendor now has a say in how we operate and grow. We each have a role in the success of not only our own business but our neighbors’ as well” says North, who serves as Board President. “By working together we can accomplish great things.”

The new business opened its doors on January 20, 2016 with 20 local vendors selling antiques, jewelry, up-cycled furniture, original art, home goods, meats, and produce. Unlike many “mall-type” markets, HTC does not work around pre-defined stalls or booths. Some vendors need only a few shelves for their products; others need lots of floor space, so HTC’s board works hard to find the right space and lay-out for each vendor, which allows businesses of all sizes to participate.

One year after opening, HTC hosts nearly 60 vendors. Merchants and local artisans offer a variety of workshops in everything from essential oils to painting to fly-tying. HTC is a thriving hub of entrepreneurial spirit and activity – a place to share ideas, gather resources, be inspired, and find support. In partnership with the SV SBDC, HTC offers business development resources to budding entrepreneurs throughout the community. Together they are partnering with Page County Public Schools to conduct the Young Entrepreneurs Program in 2017, and plan to expand their cooperative retail model to the food and service sectors in the future.

To learn more, visit www.hawksbilltradingcompany.org

This success story is dedicated to Paul Keppel III, Principal Broker of the ProRealty Group in Harrisonburg, VA . Paul was extremely helpful in the leasing process with the SV SBDC and Blossom Spas. Paul suddenly passed away one week after Vunly signed the lease. He would be proud of their achievement.

Starting a business is neither an easy, nor a quick process – and if anyone knows this to be true, its Vunly Luangrarj, owner of Blossom Spas in Harrisonburg. Vunly, who is originally from the country of Laos, came to the Shenandoah Valley SBDC for advice and support as she was determined to open her own nail salon. Although she had previously owned successful food businesses in the past, Vunly faced skepticism from family and colleagues who were concerned about her competing in the pre-existing and saturated nail salon market.

With unwavering determination and support from her daughter Mim, Vunly was able to realize her dream of building a 1700 square-foot full service nail salon within just one year. Along the way, Vunly faced many obstacles; a language barrier proved to be one of them. Proficient, but not yet fluent in English, Vunly relied on the assistance of her daughter and the SV SBDC to help translate and explain important forms and documents. Updated building codes and new regulations for air quality affected the budget dramatically. A local attorney, Jared Burden helped to decipher terms of the lease agreement enabling her to negotiate with the landlord, while the architects from Blue Ridge Design were patient and careful to understand Vunly’s vision for the salon. Just three months after signing the lease, the spa was fully built and furnished with a new ventilation system, pluming, flooring and lighting.

Today, Blossom Spas employs approximately 6 licensed technicians and cosmetologists specializing in Nail Care, Facial Services, and a full range of Eye Beauty care including Lash Extensions. Daughter Mim Luangrarj has been instrumental in adding to the interior design, and developing marketing materials plus constantly keeping up with social media. “Something I take the most pride in is the supportive culture that we’ve cultivated with our staff. Each person brings a unique value to our team. We are culturally diverse staff and collectively, we take pride in providing the very best service for our clients together.”

Blossom Spas has received overwhelmingly positive feedback from customers, including those who travel an hour over the mountains of West Virginia to Harrisonburg for services. Customer Carrie Moyers reviewed Blossom Spas on Facebook in November and said: “Today was my first time visiting & I was blown away by how nice & clean the environment was! There was no smell of fumes or anything! The ladies were so very sweet & kept me laughing the whole time! I was also given a pomegranate smoothie to try & it was amazing! I am very pleased with how well my nails look. I have officially found my new place to get my nails done!”

To learn more visit www.blossomspas.com

A Shenandoah Valley landmark for over 25 years, the Dayton Market brings visitors and residents together in a casual, friendly setting.

Located two miles south of Harrisonburg, the Town of Dayton is one of the oldest settled communities in Rockingham County. Surrounded by prime agricultural farmland, this historic land is populated by many members of the Old Order Mennonite community. With working farms and open spaces, traveling through Dayton and the surrounding area is a step back in time. Horse-drawn buggies remain a common form of travel on rural roads throughout the community.

Since 1987, The Dayton Market has been a shopping destination for both locals and tourists including Massanutten Resort’s weekly annual visitors. The Dayton Market (formerly known as the Dayton Farmers Market) is an eclectic collection of 20 specialty shops owned by individual, local merchants. When owner Fred Shank was faced with the need to update the façade and internal layout, he was referred to the Shenandoah Valley SBDC. Director Joyce Krech and VSBDC Retail Consultant Marc Willson met Fred for a tour of the Shops and discussed the market’s physical layout and “wayfinding” challenges as well as the outer façade and signage. Fred in turn recommended that the merchant-run Advertising Committee meet with the SBDC. Business Advisor Allison Dugan joined the effort and over the next few months led the committee in an extensive review and assessment process of their advertising needs and business brand.

They reviewed the Market’s Web presence, usability of the existing Website, the “findability” of their directory listings, and major referral sources. Rich and lively discussion continued to identify attributes of their customers and target markets, as well as brainstorming key historical descriptions of the Market. Were their descriptions up-to-date and accurate? Were the meeting customer expectations?

Allison introduced some of the SBDC’s GrowthWheel® tools to the group, including the Branding Opportunities Framework that highlighted the four areas that form the brand of a business: Visual Identity, Physical Identity, Voice Identity, and Attitude Identity fit together like a puzzle to create a full customer experience. The Committee discussed some complex considerations such as how can individual shops, in addition to their own marketing efforts, support the overall marketing message of the Market (and vice-versa), for a united effort and message? How can the exterior and interior designs and layout of the Market support the branded marketing message? And finally, the big question: should we look at re-naming the Market if “farmer’s market” has a different meaning to customers than it did two decades ago?

The SBDC brought in local branding expert Jaye Brumfield to discuss visual identity and the importance of building a distinctive and easily recognizable name and simple logo. Then they facilitated an independent Focus Group comprised of local business owners, destination marketers, and front-line hospitality managers with the goal of gathering a fresh and objective perspective, honest feedback, and candid comments on the continuing development of the name, logo, and tagline for the Market.

The Committee used all the data and feedback to present findings to the full meeting of shop owners. Change of any kind, especially of a branded name, is always challenging but the committee worked diligently and used the resources available to them to present sound reasoning and a plan for adapting a new logo and name. On November 7, 2015 The Dayton Market was re-introduced with the tagline “a community of shops” which the merchants felt expressed all of the aspects of their past, present and future as a very special place for merchants and customers – for friends – to gather.

The committee, shop owners, and Dayton officials continue to work closely with the SBDC to expand marketing strategies and grow as one community.

To learn more, visit www.thedaytonmarket.com