Staffing Challenges Resource page from the Virginia SBDC is now available.

August 25, 2021

The Staffing Challenges Resource pages are now live on the Virginia SBDC Website in the Business Recovery Center. These resources are intended to support employers dealing with the challenges of recruiting and retaining employees as the economy reopens.

Resources can be found here: https://www.virginiasbdc.org/employees-in-the-post-covid-economy/

April 27, 2021

Restaurant Revitalization Fund Update

March 15, 2021

Preparing to Apply for these Upcoming Grants

Shuttered Venue Operators Grant

Restaurant Revitalization Fund

1. Attend these Webinars

Shuttered Venue Operators Grant

Wednesday, March 17th 12:00pm This webinar will present some information for applicants to prepare for the Shuttered Venue Operators Grant application that is currently scheduled to open in early April. While all the details for the program have not been finalized, there are some advance steps that businesses may need to do now to better prepare for the application process.

Restaurant Revitalization Fund

Thursday, March 18th 2:00pm This webinar will present some information for applicants to prepare for the Restaurant Revitalization Fund application that is currently scheduled to open in early April. While all the details for the program have not been finalized, there are some advance steps that businesses may need to do now to better prepare for the application process.

2. Get Required Documents in Order

Shuttered Venue Operators Grant Preliminary Application Checklist

Restaurant Revitalization Fund Details coming soon!

March 8, 2021

New PPP Interim Final Rule Plus FAQS and New Application Forms Released

The following have been posted to SBA’s PPP website:

- PPP Interim Final Rule – Revisions to Loan Amount Calculation and Eligibility Effective Mar 3, 2021 – https://www.sba.gov/document/policy-guidance-ppp-interim-final-rule-revisions-loan-amount-calculation-eligibility

Lender Forms

- Paycheck Protection Program Lender Application Form First Draw Loan Guaranty (updated 03-03-21) – https://www.sba.gov/document/sba-form–lender-application-form-paycheck-protection-program-loan-guaranty-0

- Paycheck Protection Program Lender Application Form Second Draw Loan Guaranty (updated 03-03-21) – https://www.sba.gov/document/sba-form-2484-sd-ppp-second-draw-lender-application-form

Borrower Forms

- Paycheck Protection Program First Draw Borrower Application Form (updated 03-03-21) – https://www.sba.gov/document/sba-form–paycheck-protection-program-borrower-application-form

- Paycheck Protection Program First Draw Borrower Application Form for Schedule C Filers Using Gross Income (published 03-03-21) – https://www.sba.gov/document/sba-form-2483-c-ppp-first-draw-borrower-application-form-schedule-c-filers-using-gross-income

- Frequently Asked Questions – https://www.sba.gov/document/support-faq-lenders-borrowers

February 24, 2021

More Changes to the PPP Loan Program

While the PPP program continues to be an efficient and effective manner in providing assistance to the region’s small business owners, it has been noted that there are some shortcomings that need to be addressed. Recently, the Administration announced several additional changes to the current round of PPP funding. The goal of these changes is to provide greater access to capital to applicants that have been historically disenfranchised. This includes the following:

- Effective 2/24/21: For a 14-day period, only businesses with fewer than 20 employees can apply for a PPP loan.

- Sole Proprietors/Self-Employed: under existing rules, these classes of businesses were required to use Line 31, form 1040, Schedule C (a/k/a “net income”) to calculate the loan amount, which in many instances significantly reduced the amount eligible for funding. Under the revised rule, these classes of business can use “gross income” for this calculation

- An additional $1 billion of the PPP program funds are being designated for these business categories located in low-to-moderate (LMI) areas

- Support for “Second Chance” business owners, which means business owners with felony records that are not linked to fraud will now be eligible for funding

- Business owners that are delinquent on federal student loans will be eligible for PPP funding

- Businesses owned by non-citizens who are lawful US residents (those with VISAs or Green Cards) are now eligible for funding, which means they can use their Individual Taxpayer Identification Numbers (ITINs)

It is anticipated that there will be additional changes during the final month of this round of PPP funding.

It should be noted that, to date, the SBA has not published documentation on the above changes. However, this guidance, including specific dates for implementation, will soon be forthcoming. One point to remember that this program “sunsets” on 31 March, 2021.

Those individuals who are eligible for the revised PPP Loan Program should speak with their local financial institution both to obtain specific information on the latest changes, but also to be prepared to submit their application as expeditiously as possible in order to meet the deadline for this program.

Mike Austin, Access to Capital Counselor

Small Business Development Center of Hampton Roads, Inc.

January 11, 2021

Recommended Actions to Prepare for PPP Portals to Reopen

It now appears that the Paycheck Protection Program(PPP) lending portals will reopen on January 13th. However, in that the SBA has issued their revised application forms, it is not currently known when individual lenders will have their loan portals open based on the agency’s updated documentation. Furthermore, the agency has stated that they will open their portal first to “community-based lenders”, a classification of financial institution that is not well understood by the general public. However, in anticipation of the portal for “first” or “second” advance PPP loans, the following recommendations have been promulgated by multiple sources. These include:

- Determine if you are eligible, especially for those seeking a 2nd advance, for those rules are more restrictive. In addition, applicants are required to certify/prove that they need the funding; that the loan is “necessary” for them to continue to operate

- Run the numbers, to determine the amount you may be able to seek, based on the revised guidelines issued 1/6/21. Some entities will benefit more than others

- Revisit your PPP forgiveness application, if you received funds in the first round, to be sure that you have properly documented how the funds were used based on the revised use of proceeds

- Recalculate business expense deductions, based on the revised rules

- Call your lender, if you anticipate either seeking a 2nd loan or want to revisit the amount received from your first loan. Under the revised rules, many firms may find it advantageous to seek an increase in their first loan vs. seeking a 2nd round of funding. However, it is not known if lenders will create a portal for increasing existing PPP debt or require their borrowers to seek a 2nd loan. In addition, if your lender has determined they will not participate, seek out other finance avenues, include online “fintech” lenders

There remain a lot of unanswered questions concerning the new lending initiatives. Many of the program policy changes are retroactive to the initial rollout of PPP in early 2020. Unfortunately, this could create significant confusion. Directors and Advisors in the Virginia SBDC Network have worked diligently over the weekend to help decipher the new guidelines. It is our primary recommendation to seek the advice of your Accountant, Attorney and contact your relationship Banker. The SV SBDC has advisors ready to assist you as well. Please email [email protected] or contact your advisor directly as we are still working remotely from home offices.

See the SBA website for details.

New Paycheck Protection Program (PPP) Loans based on the Economic Aid Act of 2020

Although much attention has been given to the ability of existing PPP applicants to obtain a 2nd loan, for many clients in underserved markets who were unable to obtain first round funding, the rules that apply to the revised “First Draw” program merit noting (many of these guidelines also apply to “Second Draw” credits). $25 billion has been set aside for these applicants, and the guidelines include:

- Borrowers must be able to certify that the loan was “necessary”. The SBA has stated that they will not require proof for loans under $150,000, but other agencies (IRS etc.) may do so. Also, a list of all recipients will apparently be made public.

- $15 billion has been set aside for borrowers with no more than 10 employees or loans of $250,000 or less to entities located in low-to-moderate-income neighborhoods

- The maximum available for “First Draw” borrowers is $10 million and the maximum single location number of employees remains at 500

- The maximum amount of loans for seasonal employers, new entities, and businesses with more than 1 physical location

- Eligibility Entities has been expanded, and now includes the following:

- Any business entity

- Independent contractor

- Self-employed individual

- Sole proprietor

- Non-profit

- Veterans’ organizations

- Tribal businesses

- Housing cooperatives

- Small agricultural cooperative

- Eligible 501 c(6) entities (must have 300 or fewer employees, lobbying must not exceed 15% of receipts or activities, with total budgets of $1 million or less)

- Eligible nonprofit new organizations

- Destination marketing organizations

- Seasonal employer definition has been re-worked and now is an entity that operates more than 7 months or learned no more than 1/3rd of its revenue in any 6 months in the prior calendar year. Furthermore, they can calculate PPP amounts based on the average monthly payroll costs for a 12-week period selected by the borrower that began 2/15/19 or 3/1/19, and ended 6/30/19, or they can elect to use any consecutive 12-week period beginning after 2/14/2020 and ending before 1/1/21, multiplied by 2.5X, not exceeding $2 million

- New entities can qualify based on the average monthly payroll costs up through the date when they apply, multiplied by 2.5, not to exceed $2 million

- The eligible use of proceeds has been expanded to include:

- Payroll costs:

- Group life insurance

- Group disability insurance

- Group vision insurance

- Group dental insurance

- Tip income can now be included

- Non-payroll costs:

- Business software or cloud computing

- Costs incurred due to social unrest not covered by insurance

- Supplier costs

- PPE and other expenses mandated by federal, state, or local health agency requirements

- Farmers and ranchers can now use gross income for either 2019 or 2020 instead of net income

- The list of ineligible businesses has been expanded to include:

- Entities that have permanently closed

- Businesses not in operation on 2/15/2020

- Publicly traded companies

- Lobbying organizations

- Hedge funds or private equity firms

- Entities organized in the People’s Republic of China

- Entities registered under the Foreign Agents Registration Act

- Executive Branch leaders and members of Congress and spouses with 20%+ ownership

- Household employers

- Entities in bankruptcy

- Provisions also include new applications for borrowers that have returned/repaid all their original PPP loan prior to applying for the new credit

- Payroll costs:

It merits noting that further clarification of these guidelines are likely given that with the first round of funding there were 30 updates issues along with 26 pages of FAQs. Also, the lending community will need to digest these provisions and incorporate them into their lending portals prior to allowing applications. This is especially true for borrowers that may seek to increase their existing PPP loan rather than seek a “Second Draw” credit.

EIDL First Advance and PPP Forgiveness

Under the original PPP program, if a borrower also received an EIDL “first advance”, the amount of that advance would be deducted from the amount of PPP forgiveness. The recently enacted Economic Aid Act made modifications to this provision, including:

- The amount of the EIDL advance will no longer be deducted from the amount of PPP debt forgiven

- This change is retroactive, which means that for any PPP debts already forgiven for the amount reduced by the EIDL advance the SBA will reimburse lenders for all principal and accrued interest, which will in turn, pay off the amount owed by borrowers

IRS Ruling on Deductibility of PPP-Forgiven Expenses

As a result of the legislation signed late last month, the IRS has changed its ruling concerning the deductibility of expenses that are forgiven as part of a borrower’s Paycheck Protection Program (PPP) loan. As indicated in the legislation, the IRS confirms that they have rescinded its earlier guidance and has now ruled that the amounts forgiven are not taxable, but that the corresponding expenses comprising the amount forgiven can now be deducted from the borrower’s tax return. This is good news for small business clients! As always, the SBDC recommends clients to seek the advice of their Accountant, Attorney and relationship Banker.

Miscellaneous Changes to SBA Programs and Tax Policy

The recent Economic Aid Act, which became law late last month, included a plethora of changes to existing SBA and other programs that will benefit small businesses. These include the following:

- The Employee Retention Tax Credit was expanded in the following ways:

- The program was extended through June 30

- The decline in gross receipts has been decreased from 50% to 20%

- The tax credit, originally 50% of up to $10,000 in qualified wages (approximately $5,000 per employee) has been increased to 70% ow qualified wages, or up to $10,000 per quarter

- The employee size of companies has been increased from 100 to 500

- Businesses can now claim the tax credit and a PPP loan

- SBA loan debt relief extension:

- New and existing 7(a), 504, and microloans will receive an additional 3 months of principal and interest relief, capped at $9,000 per borrower per month, starting in February

- Businesses in hard-hit industries will receive an additional 5 months of relief

- The SBA will also cover the principal and interest payments on new loans approved between February 1st and September 30th, also capped at $9,000/month

- SBA guarantees:

- SBA guarantees will increase to 90% and will waive borrower and lender fees on 7(a) and 504 loans

Huge credit for these simplified memos goes to Virginia Small Business Development Center Financial Analyst, Mike Austin.

December 11, 2020

As of December 9, 2020, Rebuild! VA has exhausted all available grant funds and will not be able to accept or process any additional applications. We are hopeful that Congress will soon pass a stimulus package that provides additional relief to small businesses.

What does this mean for you? Below are the latest resources from the Governor’s office to answer some of the questions you may have. Please contact your SBDC Business Advisor directly if you have additional questions.

December 7, 2020

12 Most Commonly Asked Rebuild VA Grant Questions & Awesome Answers

Frequently Asked Questions

- Am I eligible for the Rebuild VA grant?

- What is the status of my application? Have you received my application?

- What does my application status mean?

- I’m locked out of the portal, how do I get back in?

- When will I receive my check?

- I saw the grant amount has expanded to a maximum of $100,000. If I already received a grant, can I reapply?

- How can I change the grant amount I requested on my application?

- How do I update my application?

- How can I add more documentation to my application?

- Is there a deadline to apply for the Rebuild VA grant?

- What are the tax consequences of being awarded a Rebuild VA Grant?

- Do I have to pay back the grant or are there any follow-up requirements for the grant if I

am approved?

12 Most Commonly Asked Rebuild Q’s and Awesome Answers!

November 13, 2020

Governor Northam Announces New Statewide Measures to Contain COVID-19

Includes limit of 25 individuals for in-person gatherings, expanded mask mandate, on-site alcohol curfew, and increased enforcement

RICHMOND—As COVID-19 surges in states across the country, Governor Ralph Northam today announced new actions to mitigate the spread of the virus in Virginia. While the Commonwealth’s case count per capita and positivity rate remain comparatively low, all five health regions are experiencing increases in new COVID-19 cases, positive tests, and hospitalizations.

“COVID-19 is surging across the country, and while cases are not rising in Virginia as rapidly as in some other states, I do not intend to wait until they are. We are acting now to prevent this health crisis from getting worse,” said Governor Northam. “Everyone is tired of this pandemic and restrictions on our lives. I’m tired, and I know you are tired too. But as we saw earlier this year, these mitigation measures work. I am confident that we can come together as one Commonwealth to get this virus under control and save lives.”

Governor Northam shared a new video to update Virginians on the additional steps the Commonwealth is taking to mitigate the spread of COVID-19, which is available here.

The following measures will take effect at midnight on Sunday, November 15:

- Reduction in public and private gatherings: All public and private in-person gatherings must be limited to 25 individuals, down from the current cap of 250 people. This includes outdoor and indoor settings.

- Expansion of mask mandate: All Virginians aged five and over are required to wear face coverings in indoor public spaces. This expands the current mask mandate, which has been in place in Virginia since May 29 and requires all individuals aged 10 and over to wear face coverings in indoor public settings.

- Strengthened enforcement within essential retail businesses: All essential retail businesses, including grocery stores and pharmacies, must adhere to statewide guidelines for physical distancing, wearing face coverings, and enhanced cleaning. While certain essential retail businesses have been required to adhere to these regulations as a best practice, violations will now be enforceable through the Virginia Department of Health as a Class One misdemeanor.

- On-site alcohol curfew: The on-site sale, consumption, and possession of alcohol is prohibited after 10:00 p.m. in any restaurant, dining establishment, food court, brewery, microbrewery, distillery, winery, or tasting room. All restaurants, dining establishments, food courts, breweries, microbreweries, distilleries, wineries, and tasting rooms must close by midnight. Virginia law does not distinguish between restaurants and bars, however, under current restrictions, individuals that choose to consume alcohol prior to 10:00 p.m. must be served as in a restaurant and remain seated at tables six feet apart.

Virginia is averaging 1,500 newly-reported COVID-19 cases per day, up from a statewide peak of approximately 1,200 in May. While Southwest Virginia has experienced a spike in the number of diagnosed COVID-19 cases, all five of the Commonwealth’s health regions are currently reporting a positivity rate over five percent. Although hospital capacity remains stable, hospitalizations have increased statewide by more than 35 percent in the last four weeks.

On Tuesday, Governor Northam announced new contracts with three laboratories as part of the Commonwealth’s OneLabNetwork, which will significantly increase Virginia’s public health testing capacity. Contracts with Virginia Tech in Blacksburg, University of Virginia Medical Center in Charlottesville, and Sentara Healthcare in Norfolk will directly support high-priority outbreak investigations, community testing events, and testing in congregate settings, with a goal of being able to perform 7,000 per day by the end of the year.

The full text of amended Executive Order Sixty-Three and Order of Public Health Emergency Five and sixth amended Executive Order Sixty-Seven and Order of Public Health Emergency Seven will be made available here.

For information about COVID-19 in Virginia, visit vdh.virginia.gov/coronavirus.

October 30, 2020

NEW PPP FORGIVENESS FACTSHEET FOR BORROWER AUDIENCE

A PPP factsheet for borrowers that provides a high-level overview of what they have to do as part of the PPP Forgiveness process is now available. Borrowers in all cases should work with their PPP lenders on forgiveness.

In Case You Missed It: Did you know that PPP Forgiveness information is available in 17 languages? You can find all 17 languages by visiting https://www.sba.gov/page/coronavirus-recovery-information-other-languages#section-header-0

September 24, 2020

Rebuild VA has expanded its eligibility criteria to allow more small businesses to apply. The application is open and available here.

Small supply chain partners of businesses forced to close under Executive Order 53 or 55, as well as businesses that received CARES Act funding, are now eligible to receive a $10,000 Rebuild VA grant. Businesses that have received CARES Act funding must certify that they will only use the Rebuild VA grant for recurring expenses and that the grant will not be used to cover the same expenses as the other CARES Act funds.

Administered by the Department of Small Business and Supplier Diversity (SBSD), Rebuild VA has received over 3,000 applications. SBSD and its program partners, the Department of Housing and Community Development (DHCD), the Virginia Tourism Corporation (VTC), and the Virginia Economic Development Partnership (VEDP), made the decision to expand eligibility criteria after analysis of eligible and ineligible applications received within the first 30 days of the launch.

More details about the program, including eligibility criteria, may be found at https://www.governor.virginia.gov/rebuildva/.

In addition, DHCD has created a quick guide for multiple small business recovery programs in the agency. Click here to access the document.

September 14, 2020

Small Businesses & Recovery: What Customers Want

We surveyed the community to find out how they feel about a variety of topics related to public health and what influences the decisions they make about the places they visit and patron.

The previous implementation of this survey was administered in advance of the lifting of restrictions on small businesses and mass gatherings in Virginia. Those results depicted customers’ attitudes prior to Virginia entering Phase 1 of reopening.

This summary covers the results of a follow up to that survey, which was administered during Phase 3 of Virginia’s reopening. Brief comparisons are included at the end of each question to provide context on how customers’ attitudes have shifted since the previous survey.

The survey was shared by organizations and local governments in the City of Harrisonburg and Rockingham County. We received feedback from 435 survey respondents.

Key takeaways:

- Customers want businesses to make public health a priority. They want businesses to continue taking precautions that keep both employees and customers safe, and they want these precautious to be posted or shared, physically or virtually (Q1, Q11, Q12).

- There was a 21.9% increase in the number of survey respondents who said “employees wearing facemasks” impacted their level of comfort patronizing a business (Q1).

- Customers wish to touch as few common surfaces as possible (Q5, Q8, Q10).

- The number of people inside could impact customers’ desire to enter or stay (Q1, Q7).

- Many respondents indicated they have already started patronizing retail businesses and restaurants that offer outdoor dining; however, people show much more uncertainty when it comes to dining indoors and engaging in recreational activities (Q2).

- Buffet-style restaurants and other self-service options will make people uncomfortable for a long time, as evidenced by both the previous and current survey results (Q2).

- The majority of respondents do not feel comfortable attending events or gatherings – indoors or outdoors – despite adherence to social distancing guidelines (Q3).

- Moving forward, roughly 60% of respondents indicated interest in business and social networking events that are held either virtually or in small outdoor gatherings (Q4).

- Over 76% of respondents said locally owned businesses capture their attention with products, services, and specials using Facebook or word of mouth. 55% indicated that google search results are influential (Q6).

- Many intend to frequently or occasionally shop online with locally owned retailers and restaurants that have e-commerce options available for pick-up or delivery (Q9).

How could businesses respond?

- Follow CDC/VDH guidelines; regularly check for new information and adapt.

- Frequently disinfect commonly touched surfaces, such as handles and card machines. Do this in front of customers.

- Post signs explaining precautions outside and inside the establishment as well as on social media pages. Ensure all employees and customers are following what is posted.

- Continue using e-commerce systems; implement e-commerce if not already in place.

- Use Facebook and Instagram to enhance your marketing – highlighting actual products, menu, items and detailed descriptions that encourage people to make a purchase. Use google adwords as part of your marketing strategy so your website can get “found” more easily.

- Explore “touchless” and low-contact systems for your business, such as: disposable paper or QR Code menus, posted chalk board menus, touchless payment, and other strategies.

- Limit the number of patrons inside establishments. If it is feasible with the type of business or establishment, consider taking reservations (using free online tools) or making appointments.

- Install automatic hand sanitizer dispensers.

- Continue offering curbside pick-up and delivery options.

- Continue offering or try implementing “senior hours” for older customers.

- Use social media and e-newsletter lists to engage customers and ask for feedback on plans. Ask customers what you can do to retain their business through this time.

- Share positive Google/Facebook/Yelp reviews that recognize your efforts to keep your staff and customers safe on social media & let your customers speak for you!

VIEW THE ENTIRE Taskforce_Customer Survey Summary Phase 3

August 12, 2020

The Harrisonburg Business Recovery Grant program has launched! Grants for businesses with 1-100 employees are available. Grant amounts are between $4,000 and $10,000, based on the total employment of the business.

To view the eligibility criteria and to apply, visit: https://harrisonburgdevelopment.com/harrisonburg-business-…/

The deadline to apply is August 27th at 5:00pm.

Paycheck Protection Program (PPP) Policy Update – Tuesday, August 11, 2020

SBA & Treasury have recently released additional guidance:

- Interim Final Rule – Appeals of SBA Loan Review Decisions Under the PPP (Released 8/11/20)

- Frequently Asked Questions – FAQs # 50 and #51 have been added (Released 8/11/20)

- Frequently Asked Questions For Loan Forgiveness (Released 8/11/20)

- Summary of PPP lending as of 8/8/20 (Released 8/11/20)

For more information and updates, visit SBA.gov/PaycheckProtection or Treasury.gov/CARES

August 11, 2020

REBUILD! VA Frequently Asked Questions

REBUILD! VA Application & Certification

August 11, 2020

New Resource Guide for Building a Sustainable Recreational Economy

USDA launched a resource guide to provide rural community leaders and economic development practitioners a complete list of programs at Rural Development, Forest Service, and National Institute for Food and Agriculture that can be used to support recreational economies in rural America.

USDA launched a resource guide to provide rural community leaders and economic development practitioners a complete list of programs at Rural Development, Forest Service, and National Institute for Food and Agriculture that can be used to support recreational economies in rural America.

This guide addresses key factors necessary to build a sustainable recreational economy including natural resource management, conservation activities, infrastructure investment, business development and more.

Download the resource guide:

Recreation Economy at USDA: Economic Development Resources for Rural Communities

July 31, 2020

Tips for Handling Legal Issues in the Wake of COVID-19

“Navigating the Legal Landscape During a Pandemic,” is a recently published guide by Online Master of Legal Studies Programs. The guide provides a glossary of related terms and FAQ’s to help individuals understand new legal situations. Tips on how to address common legal concerns such as employee and rental rights are detailed within the resource. The article also shares information on looking towards the future, such as how business professionals can prepare during and after a pandemic.

Main Street America, in partnership with The Hartford Small Business Insurance has created The HartBeat of Main Street Grant Program that will fund solutions to help small business owners respond and adapt to the COVID-19 pandemic, and also help to revitalize and strengthen older and historic downtown commercial districts. Grants of $5,000 to $15,000 will be awarded on a competitive and first-come, first-served basis. A minimum of 50 percent of grants will benefit diverse-owned businesses, as defined by the Small Business Administration as minority, woman, veteran, disabled, and/or LGBTQ-owned. This grant is now open and will close on August 23, 2020 at 11:59 pm PT or until 500 applications have been submitted, whichever is sooner.

Thanks to a $55 million significant commitment grant from Lowe’s partnering with LISC, small businesses can apply for emergency grant assistance desperately needed to stay afloat. Applications MUST be submitted by MONDAY, AUGUST 3rd ,11:59 p.m. EST.

June 26, 2020

June 26, 2020

Rockingham County Small Business Grant

Rockingham County, VA received funding from the Coronavirus Aid Relief and Economic Security (CARES) Act. The U.S. Department of Treasury guidance allows the CARES Act funds to be used for costs and expenses incurred because of the COVID-19 public health emergency, specifically mentioning the making of grants to small businesses.

A small business grant program will be the most efficient and effective way to distribute resources to small businesses in Rockingham County and its seven towns. The program can assist a small business with cash needed for working capital to support rent or mortgage payments, utility, payroll, or other similar expenses that occur in the ordinary course of business.

Applications will be accepted from July 13, 2020 until close of business, July 24, 2020. See the website and application for qualification criteria.

Grant information and link to application

June 16, 2020

SBA’s Economic Injury Disaster Loans and Advance Program Reopened to All Eligible Small Businesses and Non-Profits Impacted by COVID-19 Pandemic

To further meet the needs of U.S. small businesses and non-profits, the U.S. Small Business Administration reopened the Economic Injury Disaster Loan (EIDL) and EIDL Advance program portal to all eligible applicants experiencing economic impacts due to COVID-19 today.

SBA’s COVID-19 Economic Injury Disaster Loan (EIDL) and EIDL Advance

- The SBA is offering low interest federal disaster loans for working capital to small businesses and non-profit organizations that are suffering substantial economic injury as a result of COVID-19 in all U.S. states, Washington D.C., and territories.

- These loans may be used to pay debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact, and that are not already covered by a Paycheck Protection Program loan. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%.

- To keep payments affordable for small businesses, SBA offers loans with long repayment terms, up to a maximum of 30 years. Plus, the first payment is deferred for one year.

- In addition, small businesses and non-profits may request, as part of their loan application, an EIDL Advance of up to $10,000. The EIDL Advance is designed to provide emergency economic relief to businesses that are currently experiencing a temporary loss of revenue. This advance will not have to be repaid, and small businesses may receive an advance even if they are not approved for a loan.

- SBA’s EIDL and EIDL Advance are just one piece of the expanded focus of the federal government’s coordinated response.

- The SBA is also assisting small businesses and non-profits with access to the federal forgivable loan program, the Paycheck Protection Program, which is currently accepting applications until June 30, 2020.

For additional information, please visit the SBA disaster assistance website at SBA.gov/Disaster.

June 5, 2020

Phase Two Guidelines Virginia-Forward-Phase-Two-Guidelines 6-2-2020

|

Link to the SBDC Business Resource Guide

May 18, 2020

Payroll Protection Plan “Loan Forgiveness” details are available now on the SBA PPP Resources page.

FA$TRAK BORROWER INFORMATION FORM

For EIDL applications or updates, please contact the Office of Disaster Assistance.

Disaster Assistance (EIDL)

1‐800‐659‐2955

[email protected]

May 11, 2020

Check out the Harrisonburg – Rockingham Reopening Small Business – What Customers Want survey

May 25, 2020

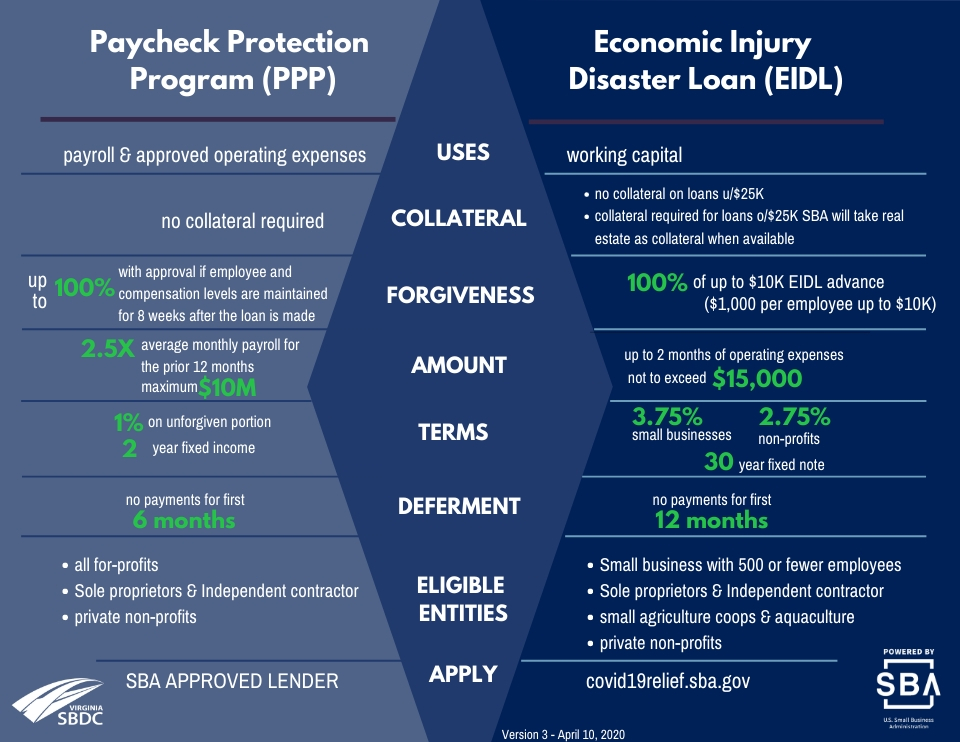

The Richmond SBA Office does a nice job explaining these programs and answering your Questions.

May 4, 2019

Notice: New Eligibility for Economic Injury Disaster Loan and Advance

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories were able to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance is designed to provide economic relief to businesses that are currently experiencing a temporary loss of revenue. This loan advance will not have to be repaid.

SBA has resumed processing EIDL applications that were submitted before the portal stopped accepting new applications on April 15 and will be processing these applications on a first-come, first-served basis. SBA will begin accepting new Economic Injury Disaster Loan (EIDL) and EIDL Advance applications on a limited basis only to provide relief to U.S. agricultural businesses.

The new eligibility is made possible as a result of the latest round of funds appropriated by Congress in response to the COVID-19 pandemic.

- Agricultural businesses includes those businesses engaged in the production of food and fiber, ranching, and raising of livestock, aquaculture, and all other farming and agricultural related industries (as defined by section 18(b) of the Small Business Act (15 U.S.C. 647(b)).

- SBA is encouraging all eligible agricultural businesses with 500 or fewer employees wishing to apply to begin preparing their business financial information needed for their application.

At this time, only agricultural business applications will be accepted due to limitations in funding availability and the unprecedented submission of applications already received. Applicants who have already submitted their applications will continue to be processed on a first-come, first-served basis. For agricultural businesses that submitted an EIDL application through the streamlined application portal prior to the legislative change, SBA will process these applications without the need for re-applying.

Eligible agricultural businesses may apply for the Loan Advance here.

April 24, 2020

If you have questions about the PPP or EIDL, here is one way to learn more with a presentation from the Richmond SBA. These webinars are free, but tend to “sell out” fast. If you think you might want to participate, register soon.